The Freelance Artist’s Survival Guide: Tax, Invoicing, and Health

The key things to think about when you start working as a freelance writer.

Being freelance can be the basis of a fulfilling and exciting working life. You have a certain flexibility as to your time and you get to work on a large range of projects with colleagues in your industry.

This is a basic guide to some of the things to think about when starting out as a freelance artist. In the post I will outline things like invoicing, tax and looking after your health. None of this is specific financial advice, it is just a broad overview.

In this post:

- Hire an Accountant

- Set up as a sole trader

- How to invoice someone

- Watch your cashflow

- Put money aside for tax

- Looking after mental and physical health

- Negotiating contracts

- Professional Associations and Trade Unions

- Showing your work

- Resources

Hire an Accountant

If you are starting to earn money as a freelancer, you will have to submit tax returns. So hiring an accountant is important - a Chartered Accountant.

An accountant can save you money. You can.offset some of the tax you pay with legitimate expenses. An accountant knows what you can offset.

They can also save you from a world of pain by ensuring you don't make mistakes in your tax return.

Set up as a sole trader

This is an important step to get help with from your accountant. Here is the Government web page about working for yourself.

A sole trader is a type of business. It’s the simplest business structure to set up and keep records for.

As a sole trader you:

- work for yourself

are classed as self-employed

- make all the business decisions

There are other types of business I won't get into here, such Limited Companies and Limited Liability Partnerships. Worth learning about.

How to invoice someone

There may be different times to invoice for the job you are working on, which should be agreed with yourself and the person who has hired you to do the work.

The invoice is just a document which contains certain information in order for the hirer to process your payment. For example : your address, the other company's address, the date, an invoice number, services provided, amount they need to pay, and the terms i.e. how long they have to pay it. Also, VAT, if you are VAT registered.

Here is a FreeAgent Accounting page on essentials to include in your invoice.

You can agree with the person you are doing the work for, how and when to invoice. If you are on a three month job, you can't be expected to wait all that time, plus another month, to have enough money to live on. You can sometimes get something at the start of a job as well.

The terms on the invoice - you can agree these at the start. You can choose if you want payment immediately, after a week, or a month. Bear in mind, that sometimes companies do not hold to these terms and sometimes you won't get paid in the timeframe you thought you would. If you work for a company that pays straight away, hold onto them!

I know one theatre director, his method for chasing up late payment was to go the company office and lie down in the middle of the floor until they paid him.

Watch your cashflow

Cash is oxygen for a business, and you are now a business. Your cashflow is the ebb and flow of your cash. Cash comes in and cash comes out. The issue to keep an eye on when you are freelance is that if someone pays you later than they should have, you will eat into your capital or savings to pay the bills.

Or you may have a lean period, which happens at times. Say a big project you were putting time aside for falls through. Or the finance department is shut over Christmas. You'll need cash set aside for that.

I would also learn about compound interest and the benefits of letting money compound over a long period of time i.e the younger you save a pound the more work it can do for you.

Put money aside for tax

This was advice I got early on when I start out and it was good advice. Part of the money you earn is not yours. You must pay tax.

So put a percentage of your savings aside every time you get paid, into a separate account which is expressly for your tax. Don't use it for a cheeky winter break.

Here is Scottish Government web page on money and tax which goes over the different tax bands and also the self-employed National Insurance rates. Here is a page on the Government website for an introduction to National Insurance.

If you ever get behind on paying your tax, get in touch with your accountant straight away as you will be fined by HMRC in short order.

The amount you set aside is higher initially than you think for the following reason. For the January 31st payment - you not only pay the tax you owe you also pay HALF in advance of the tax they think you might have to pay for the following year.

If the calculation is out and you earn less, you'll get some of that money back. But it is a hefty sum you have to shell out.

A word on VAT

A word on VAT. VAT (Value Added Tax) is something that you have to take very seriously when you are approaching a certain threshold of turnover (turnover is the total amount of money you bring in, before any expenses, tax etc are paid). At that point you have to then do quarterly VAT returns. Here is the Government page - how VAT works.

It can be hard to get the head around. In simple terms, you add a percentage onto your invoice (currently in 2026 it is 20%). Say you invoice for £100. You add VAT to that which makes it up to £120. You have to give that £20 to the Government.

The other side of the coin is - say you buy some camera equipment for £120 - which is made up of £100 plus £20 of VAT. You can claim that £20 of VAT back.

So in this example, the two amounts then cancel each other out.

The amount without VAT added is called the 'Net' figure. That is the price of the services alone. The amount with the VAT added is called the 'Gross' figure,

Death and taxes, my friend. Death and taxes.

Looking after mental and physical health

Here are two posts on the website which are helpful:

Advice for Freelancers (A guest post from Coach Sarah Fox). This is a goldmine of information. Sarah talks about vision and purpose, undercharging and overworking and looking after yourself.

The Jagged Lifestyle. An interview with CMCOSCA registered counsellor Dolina Munro with advice on how freelancers can sustain themselves during challenging times.

Negotiating contracts

If you work for someone as a writer, you will have to agree with who is hiring you both what you will get paid, but also what happens to all the rights connected to the piece of work you are creating.

This can range from a buy-out, where you do the work for a fee but you give away all your rights. To many other forms of agreement where someone buys some of your rights but not the others. i.e you sell the rights to a novel, but you keep the tv & film rights.

You can get a lawyer to help with this - ask for how they bill very early on in any conversation.

Or if you get an agent, they will negotiate this (and take 10% plus VAT).

Working with such professionals can save you a lot of money as well and protect your rights.

You can join a professional association or trade union. They sometimes offer assistance with contract vetting.

This is also an interesting looking site - copyrighter.org, which answers common copyright questions.

Professional Associations and Trade Unions

This is a very worthwhile area to investigate. As well as performing certain services, for example, collecting royalties for certain kinds of uses of your work, they produce great articles and research on important issues for writers. They are also involved in bargaining with broadcasters to set rates for writers.

WGGB - The Writers' Guild of Great Britain

If you want a guide to what the industry standard rate is for a bit of work, you can check on the WGGB site. On their site they say:

WGGB ‘minimum terms agreements’ cover writers’ rates and rights in TV, theatre, audio and some areas of film. These are the minimum terms writers are entitled to – but you or your agent can negotiate more.

This would be a good point to also mention pensions. WGGB offer a writer's pension. If you work for certain broadcasters, you can set it so a certain amount of the contract goes straight into the pension. And also, the broadcaster pays an extra percentage on top of your contract into the pension as well.

ALCS - Authors' Licensing & Collecting Society

ALCS collect royalties for you for any secondary uses ie photocopies, digital reproductions etc. On their site they say :

We make sure you receive the money you’re entitled to as a writer when someone copies or uses your work...We’re open to all types of writer, and owned by our members. The money we collect is for ‘secondary uses’ of their work...These sorts of rights typically bring in small amounts of money that are difficult for writers to monitor individually, so the most effective way to gather them is collectively.

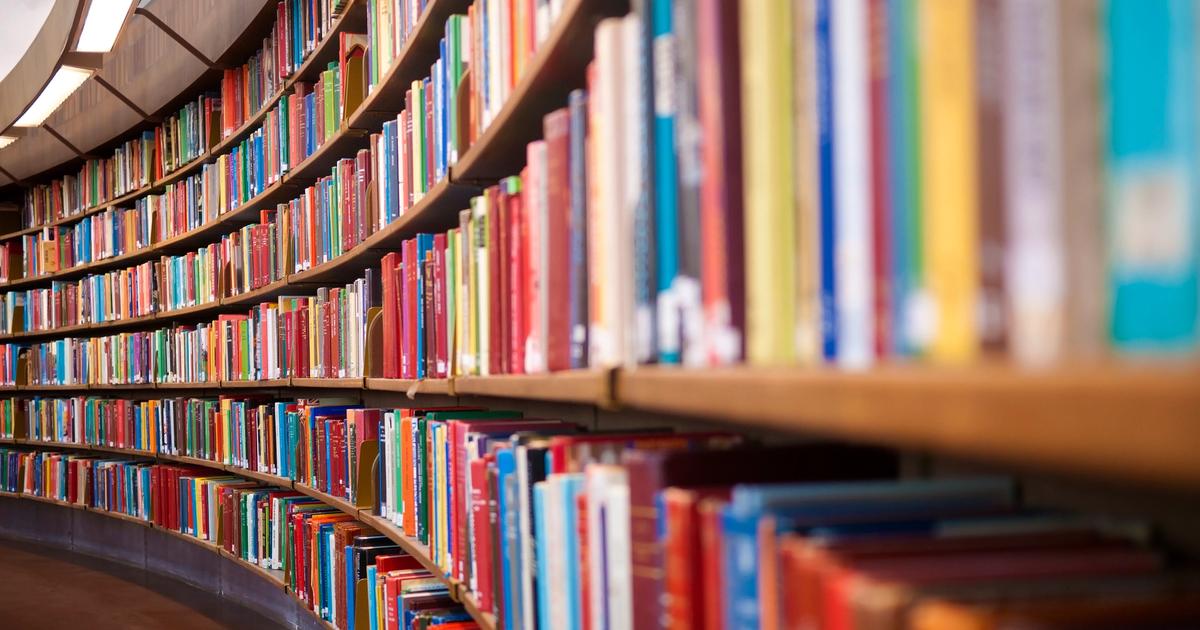

UK Public Lending Right (PLR)

If you publish work which can be borrowed from a library, you should be a member of PLR.

UK Public Lending Right (PLR) is a legal right to payment from Department of Digital, Culture, Media and Sport funding for eligible book contributors when their books are borrowed from public libraries.

Unions for Musicians, Actors and Broadcast Professionals

For musicians, the Musician's Union is a great support. Learn about MCPS & PRS. For actors - Equity. For Broadcast professionals - BECTU. For journalists - the National Union of Journalists (NUJ).

Showing your work

I have written a separate post on marketing yourself and networking.

Austin Kleon's book, Show your Work, is an encouraging book to read. I agree with him that it is worth showing your process, showing some learning in public - it doesn't have to be polished or finished work all the time. It starts a conversation and invites a response.

Having a website where you can write and show your process is important. Owning a digital home which is totally yours is important.

If you write blog posts or even record podcast episodes - it gives you a reason to get in touch with people. And people are in general so generous with their expertise. They want to 'pass it on' to those coming up. So just ask - as a friend's father always used to say - "shoot for the moon, you might get a bit of cheese."

On this site you can find writing about how to start to blog, how to protect your online writing and simple actions to take to improve SEO (Search Engine Optimisation) for your blog.

RESOURCES

If you are in Scotland find out more about Playwrights' Studio Scotland. They are an incredible organisation.

For information - as an Amazon Associate, I earn from qualifying purchases. This helps support the site at no extra cost to you.

Show your work - by Austin Kleon

The book Scots Law for Journalists by Rosalind McInnes is good.

CreativeScotland/Alba Chruthachail have a great list of organisations that can provide help and support.